As you know, there was a BIG shake up in the financial markets last month after the tariffs were announced.

😟 Whenever there’s a change to the status quo, people naturally feel uncertain about the future…

…and this impacts their financial decision making.

Now that the sales data is in, we can clearly see how this has affected Pasadena’s real estate market.

Keep in mind that home sales typically follow similar cycles throughout the year.

Activity slows down to its lowest levels as the year winds down…

And then it starts to pick back up, building momentum through February, March, and April.

🤔 But what happened this past April?

To understand the real picture, we need to look at a data point called Pending Sales.

This refers to the number of houses that are in escrow, and it reflects real time buying decisions.

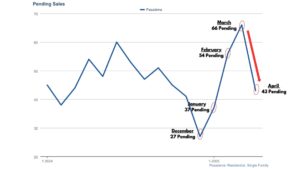

So let’s dive in and take a look at how Pending Sales have been tracking for single family homes in Pasadena.

Back in December, there were only 27 houses in escrow (i.e. 27 Pending Sales).

In January there were 37.

In February there were 56.

☝️ In March, momentum continued to build, and there were 66 houses in escrow.

But then in April, pending sales fell 33%, all the way back down to just 43.

That means far fewer buyers committed to a purchase decision in April than we’d normally expect.

Let’s get even more granular and take a look at the various market segments to see which price points were most impacted.

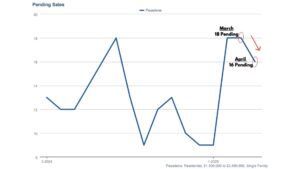

$1,500,000 to $2,500,000

Houses priced in this range were impacted the least.

For this segment, March brought 18 pending sales and April brought 16.

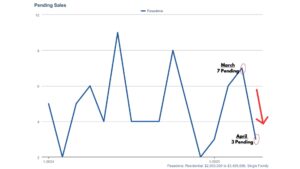

$2,500,000 to $3,500,000

This segment of the market experienced a larger drop off.

Pending sales went from 7 in March down to 3 in April.

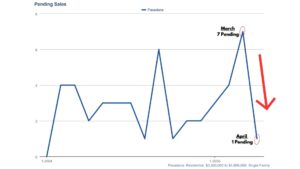

$3,500,000 to $5,000,000

The biggest impact, by far, was felt in this market segment.

In March, there were 7 pending sales while April only brought 1 pending sale.

(*For homes in the $5M+ range, the general volume of activity is too low to provide the same caliber of data-driven insights available in the lower price ranges. Feel free to contact me if you’d like to discuss this market segment further.)

So, what does this all mean for home sellers, particularly those in the $2.5M to $5M price range?…

The big drop in pending sales clearly shows that the recent economic uncertainty threw cold water on buyer demand.

⚠️ Simply put, the market has not been optimal for multi-million dollar home sellers in the weeks following the April 2nd tariff announcement.

But this will pass.

After all, the financial markets have already bounced back.

And I’m seeing activity slowly pick up in the higher price points, so I expect demand levels will soon normalize.

Because our local market is constantly changing, it’s more important than ever that you leverage the right strategies at the right time.

If you’d like to discuss your upcoming home sale or purchase with me I invite you to reach out.

You can call or text me at 626 807-6581.